Savings Bond Calculator Calculate the value of all your US savings bonds. Insert them individually or import them from a spreadsheet. Castlewood orb drivers for mac. Welcome, Individual Investors! Using the patch agent for mac. This part of the website addresses U.S. Savings Bonds and marketable U.S. Treasury securities, and the online system where you can buy both, TreasuryDirect (see links in upper left).

The Savings Bond Wizard is a programming software provided for the benefit of the consumers of the US Savings Bonds Detailed description not available Category: Data files. Interest Rate Info. This is a simple and convenient app for bond values. Since the US Treasury no longer provides the Savings Bond Wizard program/app, it would be very helpful to have interest rate information available for the bonds (ex. rate history, current rates, etc.).

As of January 1, 2012, paper savings bonds are no longer sold at financial institutions. This action supports Treasury’s goal to increase the number of electronic transactions with citizens and businesses. Revista tecnica del automovil gratis pdf.

Series EE savings bonds are low-risk savings products that pay interest until they reach 30 years or you cash them, whichever comes first. The only way to buy EE bonds is to buy them in electronic form in TreasuryDirect. We no longer issue EE bonds in paper form. As a TreasuryDirect account holder, you can purchase, manage, and redeem EE bonds directly from your web browser.

Use EE bonds to:

- Supplement retirement income

| Current rate: | 0.10% for bonds issued May 2021 – October 2021 |

| Guarantee: | Bonds we sell now will double in value if kept for 20 years |

| Minimum purchase: | $25 |

| Maximum purchase (per calendar year): | $10,000 |

| Denominations: | $25 and above, in penny increments |

| Issue method: | Electronic, in TreasuryDirect |

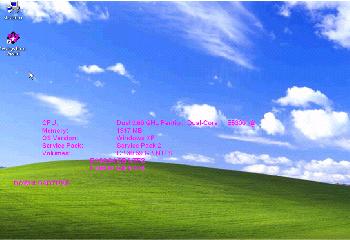

Savings Bond Wizard 5

Rates & Terms

- Series EE bonds issued May 2005 and after earn a fixed rate of interest.

- EE bonds purchased between May 1997 and April 30, 2005, earn a variable rate of interest.

- Interest is added to an EE bond monthly and paid when you cash the bond.

- Paper bonds were sold at half the face value; i.e., you paid $25 for a $50 bond.

- Electronic bonds purchased via TreasuryDirect are sold at face value; i.e., you pay $25 for a $25 bond.

- At 20 years, a bond we sell now will be worth twice what you pay for it. If you keep the bond that long, we make a one-time adjustment then to fulfill this guarantee.

Redemption Information

Savings Bond Wizard Update

- Minimum term of ownership: 1 year

- Interest-earning period: 30 years or until you cash them, whichever comes first

- Early redemption penalties:

- Before 5 years, forfeit interest from previous 3 months

- After 5 years, no penalty

Savings Bond Wizard Replacement

Tax Considerations

- Savings bonds are exempt from taxation by any State or political subdivision of a State, except for estate or inheritance taxes.

- Interest earnings are subject to Federal income tax.

- Interest earnings may be excluded from Federal income tax when bonds are used to finance education (see education tax exclusions). Restrictions apply.

EE Bond-Related FAQs

Is There A Replacement For Savings Bond Wizard

- What happens if I lose my paper bond?

- Is my EE bond eligible for the Education Tax Exclusion?